- Vanilla: Bottom-UP DP + 2D numpy Array

- Time complexity: N^2

- Space complexity: N^2

- Knock-out: Bottom-UP DP + 1D numpy Array

- Time complexity: N^2

- Space complexity: N

- Knock-in:

- Vanilla 2D numpy Array + DFS with memo

- Time complexity: N^2

- Space complexity: N^2

- (TODO) Bottom-up DP to calculate (1) activated node(i,j)'s vanilla price Or (2) if not activated, do as usual

- Time complexity: K x N^2

- Space complexity: N

- Vanilla 2D numpy Array + DFS with memo

- N cannot be too large (i.e N=500 is used in test cases)

- losses of precision vs Speed

- float vs decimal

- Error Propagation vs iterative algorithm

# Initialise parameters

S0 = 100 # initial stock price

K = 110 # strike price

T = 0.5 # time to maturity in years

r = np.log(1+0.06) # annual risk-free rate

sigma = np.log(1+0.3) # Annualised stock price volatility

periods = range(10, 500, 10) ============================= test session starts =============================

collecting ... collected 1 item

test_options.py::MyTestCase::test_knockin_knockout_parity

============================== 1 passed in 1.77s ==============================

Process finished with exit code 0

PASSED [100%]

--------------------Input Parameter-----------------------------------------------------------

risk_free_rate= 0.009950330853168092 vol= 0.26236426446749106 N= 500 spot= 100.0 K= 95.0 T= 1.0 H= 105.0 shares= 1

--------------------Computation---------------------------------------------------------------

Vanilla Call PV at t=0: 13.371077462005541

Up-And-In Call PV at t=0: 13.318153535622839

Up-And-out Call PV at t=0: 0.05292392638270593

--------------------Equality for Knock-out + Knock-in = Vanilla --------------------------

knock_out_pv+knock_in_pv = 13.371077462005545 , vanilla_pv = 13.371077462005541 BS_Model= 13.370147046851775

--------------------End ------------------------------------------------------------------

============================= test session starts =============================

collecting ... collected 1 item

test_options.py::MyTestCase::test_knockout_fast_slow_version

============================= 1 passed in 28.12s ==============================

Process finished with exit code 0

PASSED [100%]

--------------------Input Parameter-----------------------------------------------------------

risk_free_rate= 0.009950330853168092 vol= 0.26236426446749106 spot= 100.0 K= 95.0 T= 1.0 H= 105.0 shares= 1

--------------------Logger---------------------------------------------------------------

'Up-And-out Call, fast_version = False , model = CRR , N = 3', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0000 sec

'Up-And-out Call, fast_version = True , model = CRR , N = 3', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0000 sec

'Up-And-out Call, fast_version = False , model = CRR , N = 50', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0000 sec

'Up-And-out Call, fast_version = True , model = CRR , N = 50', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0040 sec

'Up-And-out Call, fast_version = False , model = CRR , N = 100', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0080 sec

'Up-And-out Call, fast_version = True , model = CRR , N = 100', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0040 sec

'Up-And-out Call, fast_version = False , model = CRR , N = 1000', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 1.0186 sec

'Up-And-out Call, fast_version = True , model = CRR , N = 1000', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.0559 sec

'Up-And-out Call, fast_version = False , model = CRR , N = 5000', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 25.1035 sec

'Up-And-out Call, fast_version = True , model = CRR , N = 5000', func:'price' args:[(), {'initSpot': 100.0, 'noShares': 1}] took: 0.9749 sec-

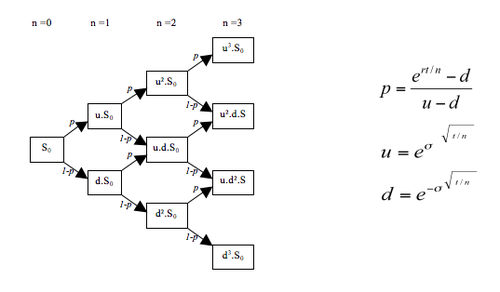

Parameters (used in code)

- T = Tenor(Years)

- n = #no of periods (e.g days)

- i = period i (n...0) //0 is 0th(start of day), i is ith(end of day), n is nth(end of day)

- j = node j at period i (0...i)

- r = continuously compounded interest rate log(1+x)

- df = e^-h*r #discount factor for 1 period

- k = strike

- b = barrier

- move = movement (up/down)

- opt = option type (call/put)

- sigma = std of continuously compounded stock return (annualized)

- h = T/n

- p = risk neutral prob. for up move

- u = e^sqrt(h)*sigma #up move

- d = 1/u #down move

- s0 = initial stock price

-

Binomial Tree

- Overlapped(u * d = 1) nodes

- At i = 3(4th day), 4 leaf nodes.

- total number of up and down movement = n-1

- At i = 3(4th day), max no. of up = 3 or max no. of down = 3

- Overlapped(u * d = 1) nodes

-

Recursion Relations for PV

PV(i,j) = df * [ p*PV(i+1, j+1) + (1-p)*PV(i+1,j) ]

-

Stock Price at jth node and ith period

s(i,j) = s0 * u^j * d^i-j

-

Existence of options at ith period

If inout=knock-out

If (move=up and s(i,j)>=H) or (move=down and s(i,j)<=H)

Then PV(i,j) = 0 # terminated

If inout=knock-in

If (move=up and s(i,j)>=H) or (move=down and s(i,j)<=H)

Then PV(i,j) = vanilla(i,j) # becomes vanilla options at (i,j)

-

Base case: Payoff at n-1th period (European)

If opt=call ,

Then PV(n, j) = max{0, s(n,j)-K}

If opt=put ,

Then PV(n, j) = max{0, K - s(n,j)}

Use of Numpy vectorization (the absence of any explicit looping, indexing, etc., in the code - these things are taking place, of course, just “behind the scenes” in optimized, pre-compiled C code)

-

Stock Price at jth node and ith period: 1D Row Vector*scalar

S = s0 * u**np.arange(0,i+1,1) * d**np.arange(i,-1,-1)

-

Recursion Relations for PV: Integer indexing + in-place and augmented assignments

PV[:i+1] = df * (p*PV[1:i+2] + (1-p)*PV[0:i+1] ) #update the view (instead of a new copy)

PV = PV[:-1] #shrink

-

Base Case (https://numpy.org/doc/stable/reference/generated/numpy.maximum.html)

- np.maximum(x1, x2)

- Compare two arrays and returns a new array containing the element-wise maxima.

- Parameters: x1, x2 (array_like)

- The arrays holding the elements to be compared.

- If x1.shape != x2.shape, they must be broadcastable to a common shape (which becomes the shape of the output).

- The arrays holding the elements to be compared.

- np.maximum(x1, x2)

If opt=call ,

Then PV = np.maximum(0, S - K)

If opt=put ,

Then PV = np.maximum(0, K - S)

-

Existence of options at ith period: Boolean Indexing with S > (scaler) output 1D dimensional result + in-place and augmented assignments

PV[move=="up" & (S>=H)] = 0 # terminated for knock-out call options

- https://blog.slcg.com/2013/01/barrier-options.html

- https://en.wikipedia.org/wiki/Binomial_options_pricing_model

- https://en.wikipedia.org/wiki/Black%E2%80%93Scholes_model

- https://en.wikipedia.org/wiki/Array_programming

- https://docs.python.org/3/library/functools.html#functools.wraps

- https://vollib.org/

- https://pythonspeed.com/articles/vectorization-python-alternatives/

- https://towardsdatascience.com/dont-assume-numpy-vectorize-is-faster-dd7e455dba2