The Salary Slip Generator allows you to generate salary slips for employees based on their provided information. This document provides a detailed explanation of how to use the API & Web UI.

The application is build in .NET 6.

The Web UI is built using Vite + React + Typescript

- API docs: https://salaryslip.azurewebsites.net/swagger/index.html

- API endpoint: https://salaryslip.azurewebsites.net/api/v1/PaySlipGenerator

See here about api details - Front-End Web Interface: https://salaryslipapp.azurewebsites.net/

To get a local copy up and running, please follow these simple steps.

Here is what you need to be able to run Salary Slip Generator locally

- Visual Studio 2022 (recommended)

- .Net 6 SDK

- Node.js (Version: >=15.x <17)

-

Clone the repo or download it.

git clone https://github.com/vndpal/monthly-payslip-generator.git

-

To run Monthly Pay Slip Generator API locally, navigate to

PaySlipGeneratorfolder.cd PaySlipGenerator dotnet run -

If you want to run it in

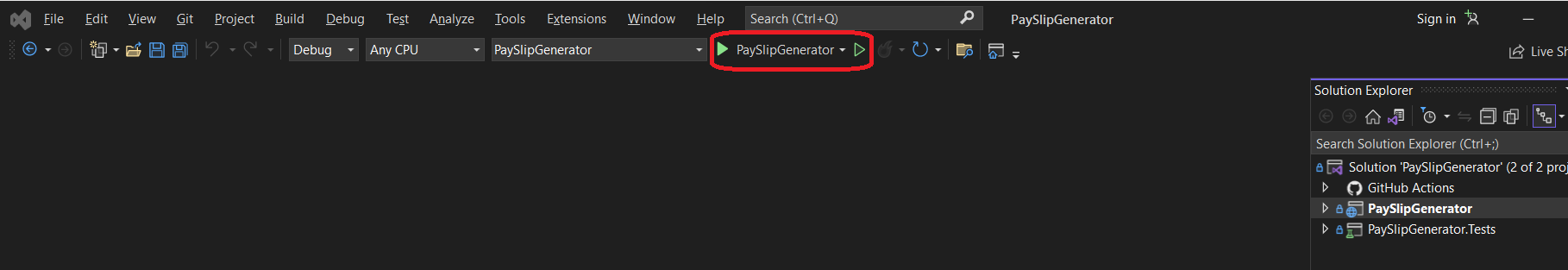

Visual Studio, then inVisual Studioopen the solution filePaySlipGenerator.slnpresent insidePaySlipGeneratorfolder. -

After this run the project using run button or press

F5key to run.

-

Make sure

PaySlipGeneratorproject is set as startup project. -

This will open up

SwaggerUI and all the details of the API will be available

-

To run front-end UI, navigate to

cliet/salaryslipporrtalfoldercd cliet/salaryslipporrtal -

Install all the dependencies using below command

npm i

-

Run the front-end UI with below command

npm run dev

-

If you get any error while running the Web UI locally after following above steps, please make sure that API endpoint is configured correctly in

.env.development. Currently it is configured to read API fromVITE_API_BASE_URL=https://localhost:7213/api/v1port7213, please modify if API is running at different port at your machine.

The Salary Slip Generator API is a service that allows you to generate salary slips for employees based on their annual salary, super rate, and pay period. By sending a POST request to the API endpoint with appropriate data in the request body, you can receive a detailed salary slip for the given employee.

- API URL:

https://salaryslip.azurewebsites.net/api/v1/PaySlipGenerator - Request Type:

POST

The request body should be a JSON object containing the following parameters:

| Parameter | Type | Description |

|---|---|---|

| firstName | string | First name of the employee. |

| lastName | string | Last name of the employee. |

| annualSalary | number | Employee's annual salary (before taxes). |

| superRate | string | Employee's superannuation rate as a string percentage (e.g., "10%"). |

| payPeriod | number | Pay period for the salary slip (e.g., 11 for November). |

Example Request Body:

{

"firstName": "John",

"lastName": "Smith",

"annualSalary": 60050,

"superRate": 9%,

"payPeriod": 3

}

The API will respond with a JSON object containing the following fields:

| Field | Type | Description |

|---|---|---|

| name | string | Full name of the employee. |

| payPeriod | string | Pay period for which the salary slip is generated. The format is "DD Month - DD Month". |

| grossIncome | number | Gross income of the employee (before taxes). |

| incomeTax | number | Income tax deducted from the employee's salary. |

| netIncome | number | Net income of the employee (after taxes). |

| super | number | Superannuation contribution for the employee. |

Example Response Body:

{

"name": "John Smith",

"payPeriod": "01 March – 31 March",

"grossIncome": 5004.17,

"incomeTax": 919.58,

"netIncome": 4084.59,

"super": 450.38,

}

The API may return the following HTTP status codes:

-

200 OK: The request was successful, and the salary slip details are provided in the response body.

-

400 Bad Request: The request is malformed or missing required parameters. Check the request body and try again.

-

500 Internal Server Error: An error occurred on the server while processing the request. Please try again later.

In case of any errors, the API will return a JSON object with an error message for easier debugging:

Example Error Response:

{

"error": "Invalid super rate. Please provide the rate as a percentage (e.g., '10%')."

}- Authentication & Authorization: Authentication and Authorization have not been implemented in the API as it falls outside the current scope. However, they can be added if required.

- Rate limiting: The API does not have any rate-limiting at the moment, but excessive and abusive requests may be blocked to ensure fair usage for all users.

- GET vs POST - Opted for POST instead of GET because we have a complex input structure, browsers doesn't cache post request by default, and POST is easier to configure future input structure.

- CORS Allowed - Allowed CORS to all applications so that anyone can integrate it. For internal or SASS projects this should be only for few allowed applications.

- Tax slabs are configured correctly - Tax slabs rates are configured correctly by the admin/support team.

- Applicable to current tax structure only: The API currently only support current tax structure.

- Maximum Salary Restricted to 999999999: The API has set a maximum salary limit of 999999999. Any salary value entered beyond this limit will result in a 400 Bad Request error. However, if needed, the API's maximum salary limit can be increased to accommodate higher values.