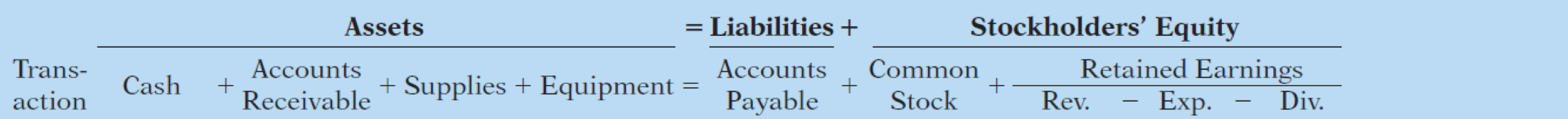

- Assets = Liability + Shareholder's Equity

- cash: coins, checks, money orders, and checking account balances

- Retained Earning <- Retained Earning + Net Income - Dividend

- Net income = Revenue - Expense

- B beginning balance

- A add revenue

- S substract expense

- E ending balance

- Cash <- Cash + Net increase in cash.

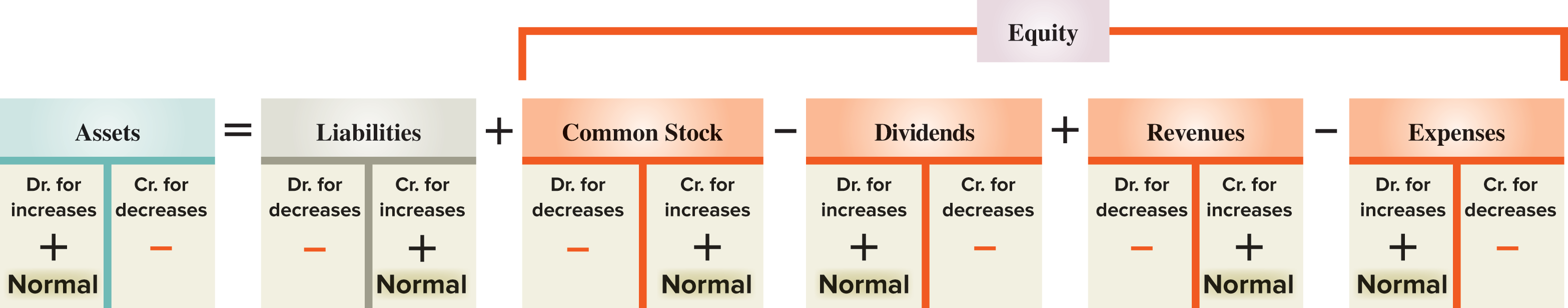

| Debit | Credit |

|---|---|

| Asset, expense, dividend | liability, revenue, equity |

- Debit must always equal credit.

- Just remember: asset moves up is debit. Anything that moves in order to keep balance must be credit.

- Prepaid insurance

- Unearned service revenue.

- Dividend does not appear on income income. It is not an expense.

- Receive money, debit asset, credit revenue

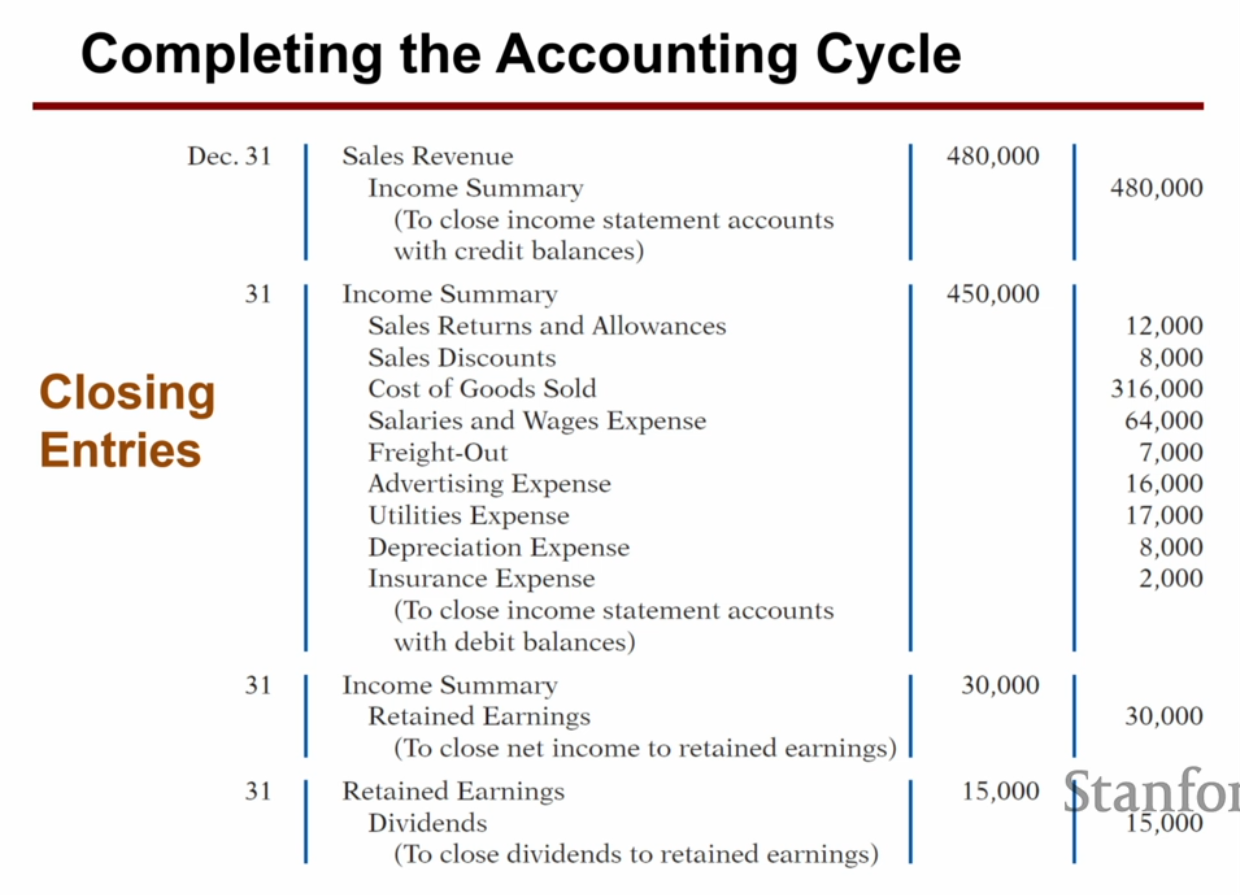

- Closing revenue account, debit revenue, credit income summary

- Incur expense, credit expense, debit income summary

- Closing book: debit (decrease) income summary, credit retained earning.

- Credit cash, debit dividend

- closing: credit dividend, debit retained earning.

Corner case: if overpaying liability, the excess is treated as asset (prepaid expense/rent/insurance), not liability.

- Creditors are individuals and organizations that have rights to receive payments from a company

- Customers and others who owe a company are called its debtors.

- accrued expense: taxes payable, and interest payable

- A journal gives a complete record of each transaction in one place. It also shows debits and credits for each trans

- date of transaction

- b titles of affected accounts

- c dollar amount of each debit and credit

- and d explanation of the transaction

- The process of transferring journal entry information to the ledger is called posting

- When entries are posted to the ledger, the debits in journal entries are transferred into ledger accounts as debits, and credits are transferred into ledger accounts as credits.

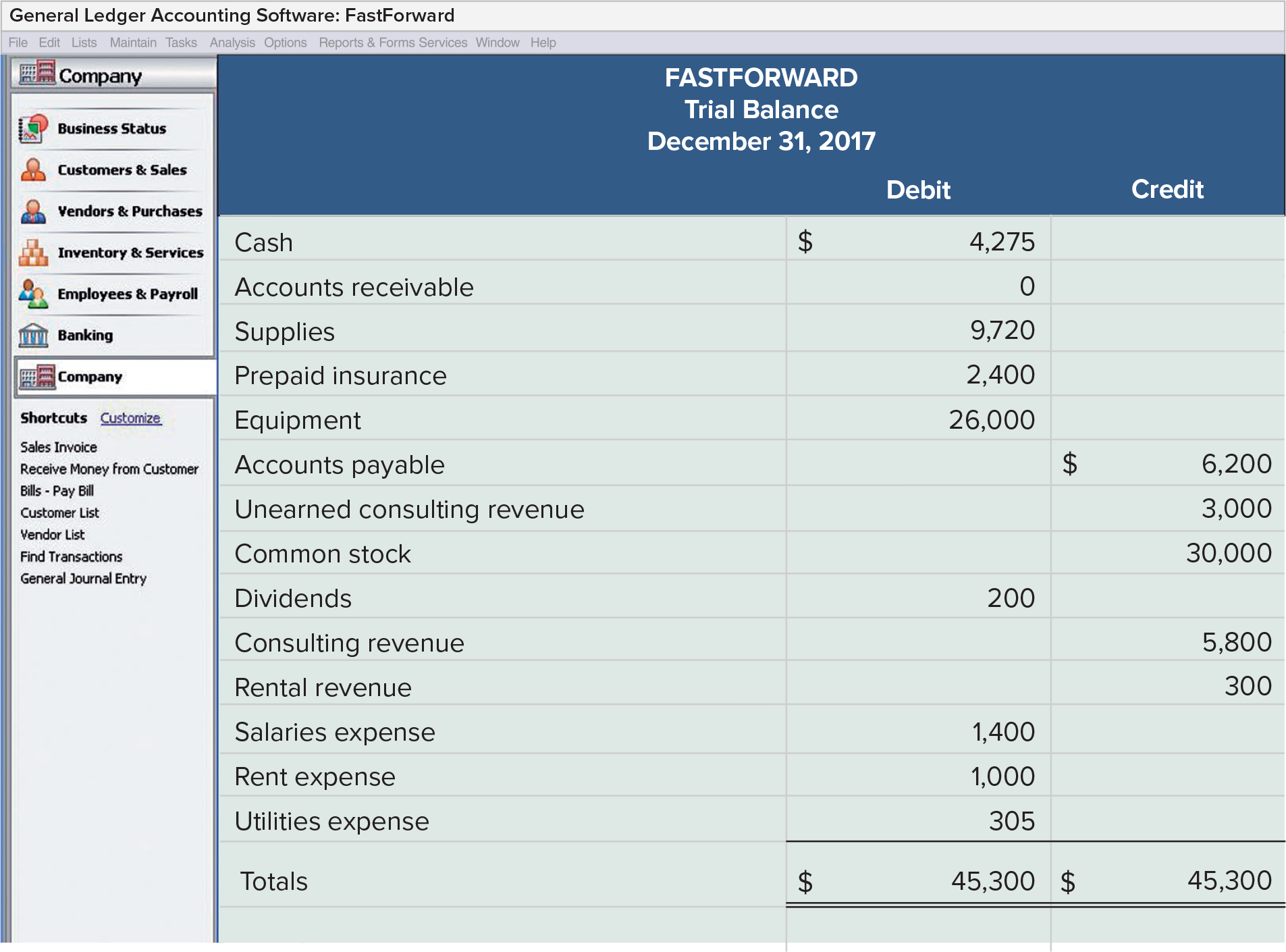

- A trial balance is a list of all ledger accounts and their balances (either debit or credit) at a point in time.

- Expense is triggers by expiration of future benefits.

- Revenue incurred when service is delivered.

- no impact on income statement when cash is received

- Receiving cash doesn't mean revenue.

Adjusting entries

- Prepaid expense/rent/insurance: asset; paid cash before expense is incurred.

- to adjust account, increase (debit) expense, decrease (credit) asset

- book value: cost - accumulated depreciation

- Accrued revenue: asset (account receivable)

- to adjust, debit cash, credit accrued revenue (account receivable)

- Unearned revenue: liability

- to adjust account, decrease (debit) unearned revenue, increase revenue (credit)

- Accrued expense: liability

- as future economic benefits expire

Borrow cash:

- debit cash, credit note payable

- accrue interest:

- debit interest expense (same direction as asset)

- credit interest payable (liability)

Pay salary

- accrue salary: debit salary expense, credit salary payable (liability)

- pay salary: debit salary payable, credit cash

Asset classes

- current asset (order matters)

- cash

- debt investment

- account receivable

- note receivable (< 12 months)

- inventory

- supplies

- prepaid insurance

- long term invest

- stock investment

- real estate investment

- PPE: land, equipment, less accumulated depreciation

- intangible asset: patents

Liability classes

- current liability,

- note, account payable (< 12 month)

- unearned service revenue

- salary, wages payable

- interest payable

- long term liability

- mortgage payable

- notes payable (> 12 month)

- stockholder equity

current ratio = current assets / current liability

- measure of liquidity

- too high is not good (no economic activity)

- too low means insolvant

- sales revenue - returns & allowance - discount = net sales

- gross profit: net sales - COGS

- operating income: gross margin - operating expense

- net income: operating income + non-operating income

- gross profit/margin ratio: gross margin / net sales

- Straight line (easiest, most common)

- Units of activity (most accurate)

- declining balance method: twice the rate of straight line

- last year takes the residual, do not depreciate below salvage

- DR depreciation expense, CR accumulated depreciation

- amortization: patent

- good will: when business is acquired; cannot create good will; excess payment of asset value

- not depreciated

- Beginning + Cost of Goods Purchased = Ending + cost of good sold

- gross profit/margin = sales - COGS

- 2, 10 net 30: 2% discount if paid in 10 days, or pay full amount in 30 days

- paid within discount period: credit cash & inventory

- Sales: debit AR, credit sales, debit COGS, credit inventory

- returns: debit sales return, credit AR, debit inventory, credit COGS

- Net sales: sales - sales return - sales discount

- Net sales - COGS = gross profit

- Customer pay with discount: debit sales discount, cash, credit AR

- Net income = net sales - operating - non-operating (interest expense, interest revenue, gain/loss of equipment sales)

- FOB shipping point: buyer incurs shipping expense

- buyer increase (debit inventory), credit cash

- FOB destination: seller incurs shipping expense

- seller debit freight out (operating expense), credit cash

- Sale:

- DR cash, CR sales

- DR COGS, CR inventory

- Common stock holders get to vote, but get reward last in liquidation

- authorized stock: how many can issue? = issued stock + treasury stock

- outstanding = issued stock - treasury stock

- only outstanding stock pays dividend

- Par value + paid in val in excess of par = cash debit

- no-par stock: cash = common stock + paid in val in excess of stated value

- treasury stock is a buffer of retained earning

- sell above treasury stock price: add additional to paid in treasury

- sell below purchase price:

- SE = paid in capital + retained earning

- paid in capital = common stock + additional paid in capital

- treasury stock

- subtract from SE

- buy treasury: debit treasury stock, credit cash

- sell treasury: debit cash, credit treasury stock and

- debit paid in treasury stock if selling below (decrease SE),

- if depleted, debit retained earning

- credit paid in treasury stock if selling above (increase SE)

- debit paid in treasury stock if selling below (decrease SE),

- Declaration: DR dividend(Retained Earning) CR payable

- Payment: DR payable, CR cash

CLAD for Operation Cash Flow

- AR increase: decrease cash flow

- AP increase: increase cash flow

- Loss & Gain:

- loss: add to cash flow

- gain: subtract from cash flow

- add depreciation

- don't care about expense

Dr dep exp

Cr accu dep

Operating acticity (income statement):

- AR, Payable

- inventory

- depreciation

- collecting interest, dividend

Financing activity (long term SE):

- issuing stocks / repurchase treasury stock

- paying Dividend

- issuing/redeem bond, debt (borrow money)

investment (long term asset)

- lending money, collecting cash on loan (not borrowing/repaying)

- acquiring/sale investment/property

Final: 4, 8, 11, 12