QuantStats Python library that performs portfolio profiling, allowing quants and portfolio managers to understand their performance better by providing them with in-depth analytics and risk metrics.

quantstats.stats- for calculating various performance metrics, like Sharpe ratio, Win rate, Volatility, etc.quantstats.plots- for visualizing performance, drawdowns, rolling statistics, monthly returns, etc.quantstats.reports- for generating metrics reports, batch plotting, and creating tear sheets that can be saved as an HTML file.

Here's an example of a simple tear sheet analyzing a strategy:

%matplotlib inline

import quantstats as qs

# extend pandas functionality with metrics, etc.

qs.extend_pandas()

# fetch the daily returns for a stock

stock = qs.utils.download_returns('META')

# show sharpe ratio

qs.stats.sharpe(stock)

# or using extend_pandas() :)

stock.sharpe()Output:

0.8135304438803402

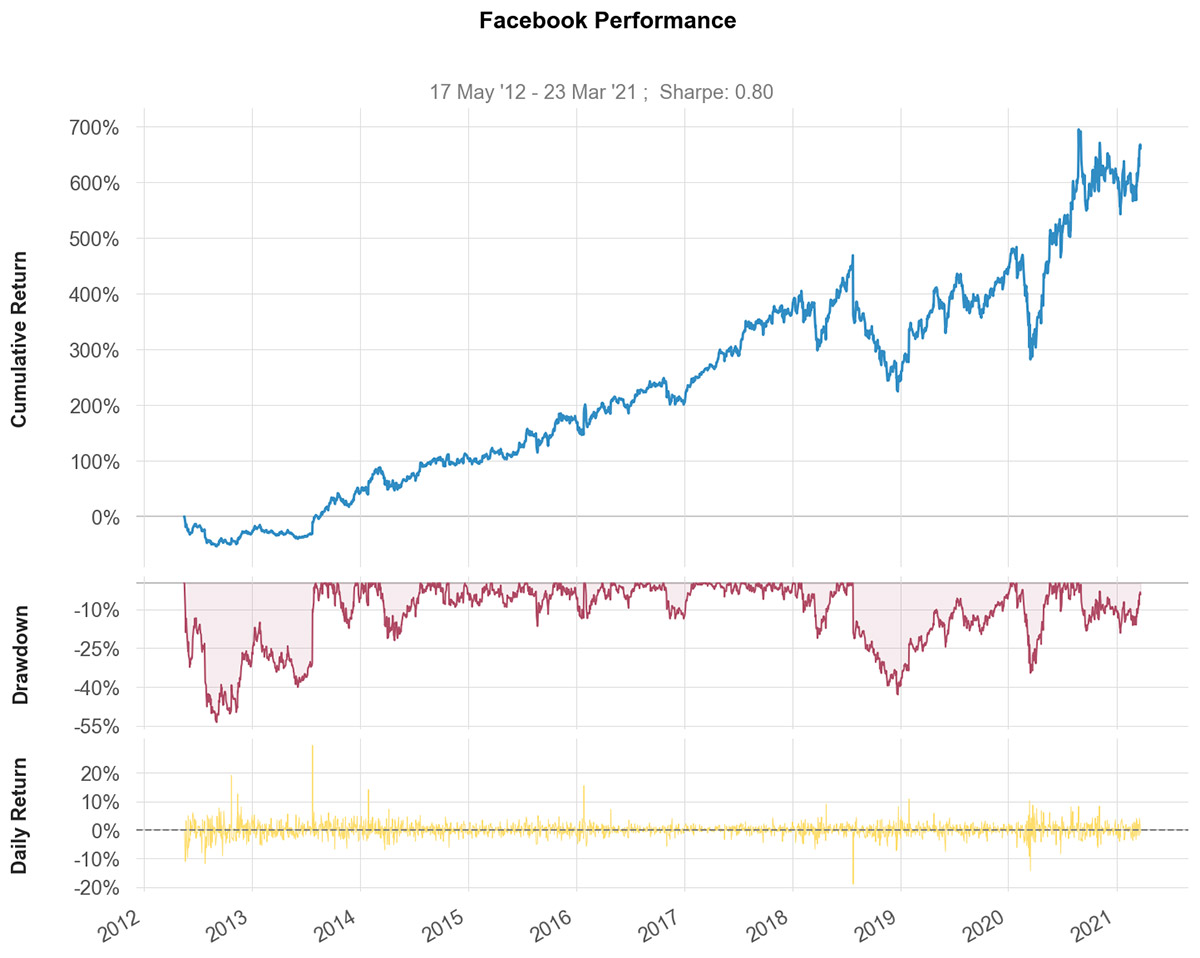

qs.plots.snapshot(stock, title='Facebook Performance', show=True)

# can also be called via:

# stock.plot_snapshot(title='Facebook Performance', show=True)Output:

You can create 7 different report tearsheets:

qs.reports.metrics(mode='basic|full", ...)- shows basic/full metricsqs.reports.plots(mode='basic|full", ...)- shows basic/full plotsqs.reports.basic(...)- shows basic metrics and plotsqs.reports.full(...)- shows full metrics and plotsqs.reports.html(...)- generates a complete report as html

Let' create an html tearsheet

(benchmark can be a pandas Series or ticker)

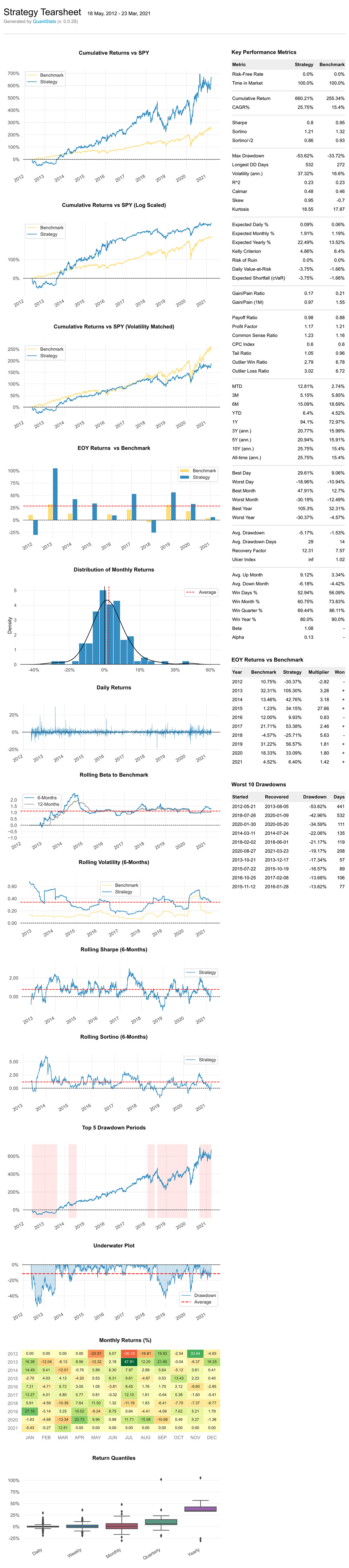

qs.reports.html(stock, "SPY")Output will generate something like this:

[f for f in dir(qs.stats) if f[0] != '_']['avg_loss',

'avg_return',

'avg_win',

'best',

'cagr',

'calmar',

'common_sense_ratio',

'comp',

'compare',

'compsum',

'conditional_value_at_risk',

'consecutive_losses',

'consecutive_wins',

'cpc_index',

'cvar',

'drawdown_details',

'expected_return',

'expected_shortfall',

'exposure',

'gain_to_pain_ratio',

'geometric_mean',

'ghpr',

'greeks',

'implied_volatility',

'information_ratio',

'kelly_criterion',

'kurtosis',

'max_drawdown',

'monthly_returns',

'outlier_loss_ratio',

'outlier_win_ratio',

'outliers',

'payoff_ratio',

'profit_factor',

'profit_ratio',

'r2',

'r_squared',

'rar',

'recovery_factor',

'remove_outliers',

'risk_of_ruin',

'risk_return_ratio',

'rolling_greeks',

'ror',

'sharpe',

'skew',

'sortino',

'adjusted_sortino',

'tail_ratio',

'to_drawdown_series',

'ulcer_index',

'ulcer_performance_index',

'upi',

'utils',

'value_at_risk',

'var',

'volatility',

'win_loss_ratio',

'win_rate',

'worst']

[f for f in dir(qs.plots) if f[0] != '_']['daily_returns',

'distribution',

'drawdown',

'drawdowns_periods',

'earnings',

'histogram',

'log_returns',

'monthly_heatmap',

'returns',

'rolling_beta',

'rolling_sharpe',

'rolling_sortino',

'rolling_volatility',

'snapshot',

'yearly_returns']

*** Full documenttion coming soon ***

In the meantime, you can get insights as to optional parameters for each method, by using Python's help method:

help(qs.stats.conditional_value_at_risk)Help on function conditional_value_at_risk in module quantstats.stats:

conditional_value_at_risk(returns, sigma=1, confidence=0.99)

calculats the conditional daily value-at-risk (aka expected shortfall)

quantifies the amount of tail risk an investment

Install using pip:

$ pip install quantstats --upgrade --no-cache-dirInstall using conda:

$ conda install -c ranaroussi quantstats- Python >= 3.5+

- pandas (tested to work with >=0.24.0)

- numpy >= 1.15.0

- scipy >= 1.2.0

- matplotlib >= 3.0.0

- seaborn >= 0.9.0

- tabulate >= 0.8.0

- yfinance >= 0.1.38

- plotly >= 3.4.1 (optional, for using

plots.to_plotly())

This is a new library... If you find a bug, please open an issue in this repository.

If you'd like to contribute, a great place to look is the issues marked with help-wanted.

For some reason, I couldn't find a way to tell seaborn not to return the

monthly returns heatmap when instructed to save - so even if you save the plot (by passing savefig={...}) it will still show the plot.

QuantStats is distributed under the Apache Software License. See the LICENSE.txt file in the release for details.

Please drop me a note with any feedback you have.

Ran Aroussi