Acid-Test Ratio Definition, Formula, Calculation, and ExampleThe Acid Test Ratio, also known as the Quick Ratio or the Liquid Ratio, is a financial indicator used to assess a company's short-term liquidity and capacity to satisfy urgent financial obligations without depending on or looking at the sale of goods. It uses the company's most liquid assets to assess its capacity to pay current liabilities. The Acid Test Ratio is determined by dividing the total of a company's cash, cash equivalents, short-term investments, and accounts receivable by its current liabilities. Because it doesn't include inventory, which could be difficult to convert into cash quickly, the Acid Test Ratio is considered a stricter liquidity indicator than the current ratio. The Acid Test Ratio sheds light on a company's capacity to promptly settle its short-term debts by concentrating on its highly liquid assets.  A higher Acid Test Ratio signifies that the corporation has more liquid assets to meet its current liabilities, which signals a stronger liquidity situation. If the ratio is over 1, the organization has more than enough liquid assets to meet its immediate obligations. The Acid Test Ratio is especially helpful in companies with poor inventory turnover or with highly arbitrary inventory levels. It aids in determining a company's capacity to manage unforeseen cash flow swings, fulfil immediate obligations, and overcome financial obstacles. Overall, the Acid Test Ratio should be understood in addition to other financial indicators and industry benchmarks because it represents a snapshot of liquidity at a particular moment. The ideal Acid Test Ratio objective might also change depending on the business style, industry, and willingness to take risks in the corporation. Characteristics of the Acid Test RatioA financial indicator called the "Acid Test Ratio" evaluates a company's short-term liquidity and capacity to satisfy current financial obligations. It focuses on how well the business can use its most liquid assets to pay its present creditors. Let's delve more into the properties of the Acid Test Ratio:

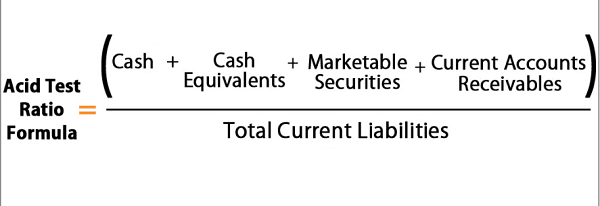

Formula and Components of the Acid Test RatioThe formula for calculating the Acid Test Ratio, also known as the Quick Ratio or the Liquid Ratio, involves several components. Let's delve into the formula and the components in detail: FormulaAcid Test Ratio = (Cash + Cash Equivalents + Short-term Investments + Marketable Securities + Accounts Receivable) / Current Liabilities  It is essential to note that we consider only total current assets without including inventories (or subtracting inventories if added) and then divide them by total current liabilities. Components of the Acid Test RatioCash:

Cash Equivalents:

Short-term Investments:

Marketable Securities:

Accounts Receivable:

Current Liabilities:

By including these components in the formula, the Acid Test Ratio measures a company's ability to cover its immediate financial obligations using its most liquid assets. It provides insight into the company's short-term liquidity position and ability to meet its current liabilities without relying on the sale of inventory. Examples of Acid Test RatioExample 1Consider a company named ABC with the following data:

We need to calculate the Acid-Test Ratio for Company ABC. Solution: As we already know the formula: Acid Test Ratio = (Cash + Marketable Securities + Short-term Investments + Accounts Receivable) / Current Liabilities Let's put all the values in this formula: Acid Test Ratio = (200,000 + 50,000 + 75000 + 100,000) / 300,000 = 425,000 / 300,000 = 1.4 In this example, Company ABC has an Acid Test Ratio of 1.4. This indicates that the company has more than enough liquid assets to cover its current liabilities. For every rupee of current liabilities, the company has Rupees 1.4 in highly liquid assets, demonstrating a strong liquidity position. This suggests that the company is well-equipped to meet its short-term obligations promptly. Example 2The following data is given for Company PQR. Find its Acid-Test Ratio.

Solution: Acid Test Ratio = (Cash + Marketable Securities + Short-term Investments + Accounts Receivable) / Current Liabilities = (50,000 + 40,000 + 30,000 + 70,000) / 250,000 = 190,000 / 250,000 = 0.8 In this example, Company PQR has an Acid Test Ratio of 0.8. This indicates that the company has 80 paise for one rupee (or 80% of the amount) in highly liquid assets to cover its immediate liabilities for every rupee of current liabilities. While the ratio is less than 1, suggesting that the company may face some liquidity challenges, further analysis is needed to assess the overall financial health and ability to meet short-term obligations. Example 3A corporation has a trade-receivables ageing report that shows a considerable percentage of past-due invoices, despite having a noticeably high Acid Test Ratio. Describe the potential effects of this circumstance on the company's liquidity position and what steps should be taken to resolve the problem. Solution: A corporation has a trade-receivables ageing report that shows a considerable percentage of past-due invoices, despite having a noticeably high Acid Test Ratio. This condition shows that the business has trouble getting client payments despite having enough liquid assets. If the past-due invoices are not collected for a prolonged time, even the high Acid Test Ratio could conceal potential liquidity issues. The business should enhance its processes for collecting unpaid invoices, enact stricter credit policies, and aggressively manage client payment cycles. These examples illustrate the application of the Acid Test Ratio in assessing the liquidity position of companies in the Indian market. It is important to interpret the ratio with other financial indicators and industry benchmarks to understand a company's liquidity and financial health comprehensively. The Bottom LineIn conclusion, the Acid Test Ratio is a crucial financial metric that provides insights into a company's short-term liquidity position and its ability to meet immediate obligations. The characteristics of the Acid Test Ratio highlight key important aspects for assessing liquidity risk. By focusing on high-quality, liquid assets and excluding inventory, the ratio emphasizes the availability of readily convertible assets to cover short-term liabilities. The Acid Test Ratio's components, including cash, marketable securities, short-term investments, and accounts receivable, play significant roles in determining a company's liquidity position. Cash represents the most liquid asset, while marketable securities provide additional sources of liquidity. Accounts receivable reflect the amount customers owe and should be carefully managed to avoid potential liquidity challenges. Ultimately, the Acid Test Ratio is valuable in evaluating a company's liquidity position, highlighting its strengths and potential risks. Regular monitoring and analysis of this ratio can aid in effective liquidity management and enhance the overall financial health of a company. Next TopicAcquiree Definition: What is it? |