Eight Days Reversal Momentum Strategy

Author: ChaoZhang, Date: 2023-12-05 10:56:37Tags:

Overview

This strategy mainly utilizes the reversal feature of prices after continuously closing above or below the 5-day simple moving average for 8 days to capture the momentum effect in medium and short term. It goes long when the closing price crosses above the 5-day line again after continuously closing below the 5-day line for 8 days; it goes short when the closing price crosses below the 5-day line again after continuously closing above the 5-day line for 8 days.

Strategy Logic

- Calculate the 5-day simple moving average SMA.

- Define the uptrend TrendUp as close greater than or equal to SMA, downtrend TrendDown as close less than or equal to SMA.

- Confirm the condition for trend reversal: trigger buy signal when closing price closes below SMA for consecutive 8 days and turns to uptrend (crosses above SMA) the next day; trigger sell signal when closing price closes above SMA for consecutive 8 days and turns to downtrend (crosses below SMA) the next day.

- Entry: long when the buy condition Buy is triggered yesterday and the current trend is downtrend; short when the sell condition Sell is triggered yesterday and the current trend is uptrend.

- Exit: close long position when closing price crosses below SMA; close short position when closing price crosses above SMA.

Advantage Analysis

- Captures momentum by utilizing price reversal features, suitable for medium and short term trading.

- High trading opportunities as continuous SMA breakout for 8 days happens frequently.

- 5-day SMA parameter performs well, avoids too many false breakouts.

- Controllable risk with clear stop loss point.

Risk Analysis

- Stop loss may be triggered frequently during market consolidation.

- May miss the best entry point if the breakout days are set too long.

- Hard to profit if there is a prolonged trend.

Can optimize SMA parameters, improve entry criteria to prevent false breakout, combine with trend indicators to strengthen the strategy.

Optimization Directions

- Parameter optimization: test different periods of SMA to find better parameters.

- Entry optimization: add volume indicators to avoid false breakouts; or judge bull/bear candles to avoid whipsaws.

- Exit optimization: test fixed percentage trailing stop loss to give more room.

- Risk control: set maximum daily stop loss times to limit losses.

- Combine indicators: add RSI, MACD to determine trend to identify market conditions.

Conclusion

The strategy captures the price movement from breakout to pullback by judging the momentum, implements the trading logic of avoiding whipsaws and trend following. The keys are strict parameter settings and robust entry criteria to prevent noise; reasonable stop loss to limit losses. Combining with trend indicators can achieve better results. The strategy logic is simple and clean. It is worthwhile to explore further optimization.

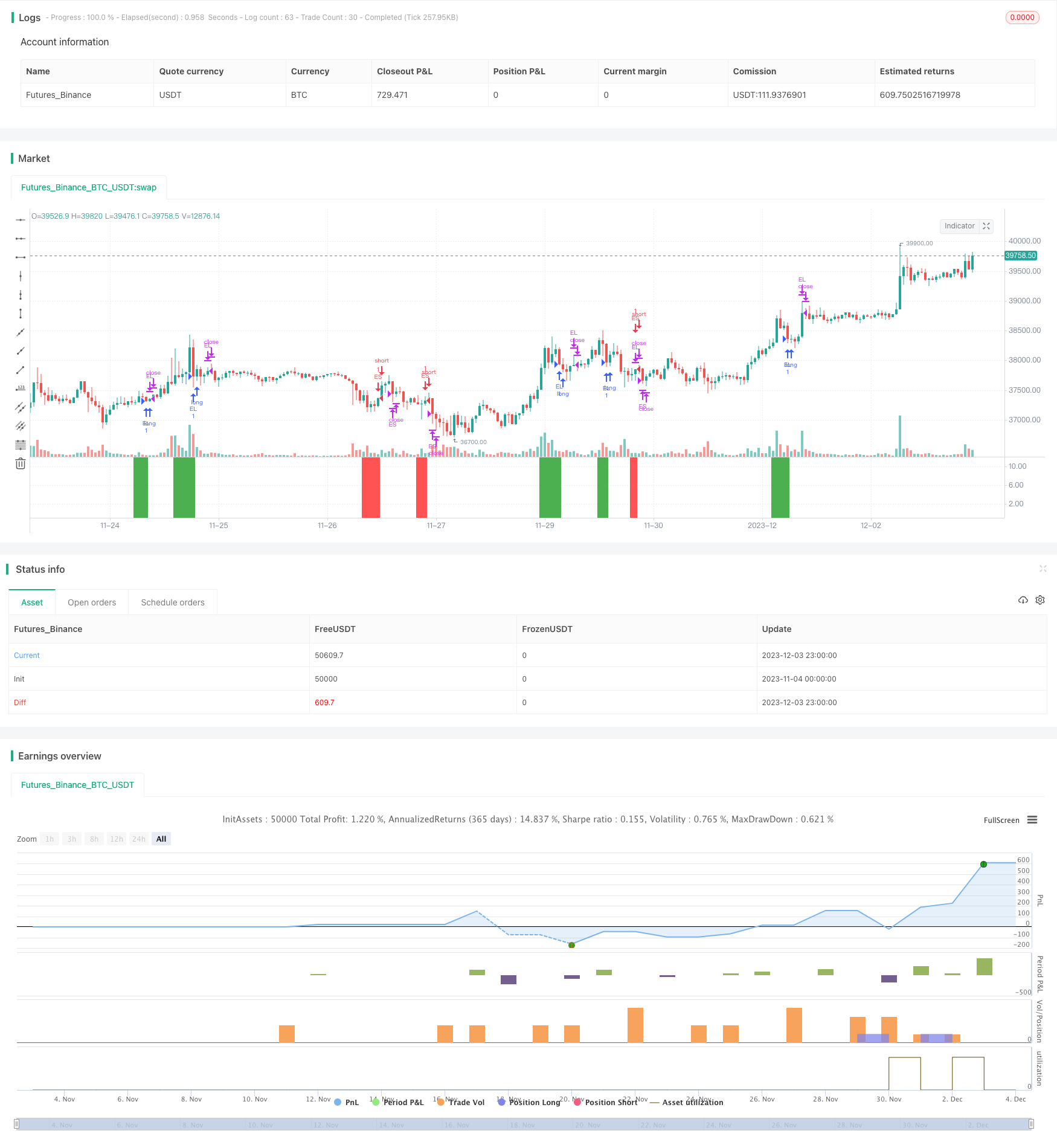

/*backtest

start: 2023-11-04 00:00:00

end: 2023-12-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Marcuscor

//@version=5

// Inpsired by Linda Bradford Raschke: a strategy for trading momentum in futures markets

strategy("8D Run", initial_capital = 50000, commission_value = 0.0004)

SMA = ta.sma(close,5)

TrendUp = close >= SMA

TrendDown = close <= SMA

//logic to long

TriggerBuy = ta.barssince(close < SMA) >= 8

Buy = TriggerBuy[1] and TrendDown

strategy.entry("EL", strategy.long, when = Buy)

strategy.close(id = "EL", when = close > SMA)

// 1) color background when "run" begins and 2) change color when buy signal occurs

bgcolor(TriggerBuy? color.green : na, transp = 90)

bgcolor(Buy ? color.green : na, transp = 70)

// logic to short

TriggerSell = ta.barssince(close > SMA) >= 8

Sell = TriggerSell[1] and TrendUp

strategy.entry("ES", strategy.short, when = Sell)

strategy.close(id = "ES", when = close < SMA)

// 1) color background when "run" begins and 2) change color when sell signal occurs

bgcolor(TriggerSell ? color.red : na, transp = 90)

bgcolor(Sell ? color.red : na, transp = 70)

- TTM Falcon Oscillator Reversal Strategy Based on Price Reversion

- Hybrid Moving Average Breakout Turtle Trading Strategy

- Low Frequency Fourier Transform Trend Following Moving Average Strategy

- STARC Channel Backtest Strategy

- PercentR Reversa Channe Strategy

- Moving Average Crossover Strategy

- Volume-driven Oscillation Quant Strategy

- Cross Moving Average Golden Cross Death Cross Strategy

- EMA/ADX/VOL-CRYPTO KILLER

- SuperTrend Multi Timeframe Backtest Strategy

- Dual Moving Average Breakthrough Strategy

- Golden Cross Moving Average Trading Strategy

- Multi Indicator Quantitative Trading Strategy

- Full Crypto Swing ALMA Cross MACD Quantitative Strategy

- Dual Moving Average Reversal Trading Strategy

- Adaptive Price Channel Strategy

- Turtle Breakout Strategy

- Mean Reversion Envelope Moving Average Strategy

- Momentum Breakout Moving Average Trading Strategy

- Dynamic Grid Trading Management Strategy