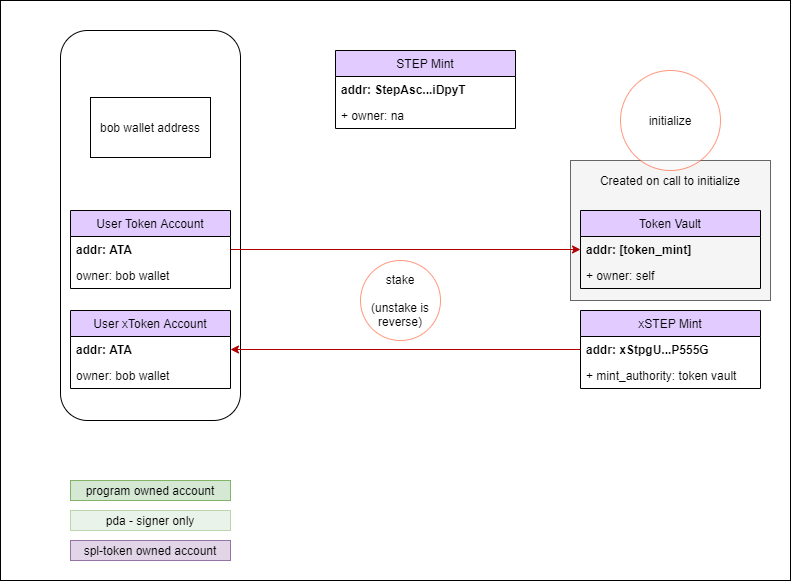

Program for single token staking and receiving rewards. Ala xSushi.

draw.io editable account design diagram

- This code is unaudited. Use at your own risk.

Anchor is used for developoment, and it's recommended workflow is used here. To get started, see the guide.

anchor build --verifiable

The --verifiable flag should be used before deploying so that your build artifacts

can be deterministically generated with docker.

When testing locally, be sure to build with feature "local-testing" to enable the testing IDs. You can do this by editing programs/step-staking/Cargo.toml and uncommenting the default feature set line.

anchor test

To verify the program deployed on Solana matches your local source code, change directory

into the program you want to verify, e.g., cd program, and run

anchor verify <program-id | write-buffer>A list of build artifacts can be found under releases.

To deploy the program, configure your CLI to the desired network/wallet and run

solana program deploy --program-id <keypair> target/verifiable/step_staking.soI would not suggest using anchor deploy at this time; it wouldn't/couldn't really add much value. Be sure to use --programid <keypair> to deploy to the correct address.

Note: By default, programs are deployed to accounts that are twice the size of the original deployment. Doing so leaves room for program growth in future redeployments. For this program, I beleive that's proper - I wouldn't want to limit it, nor do I see growth beyond double.

After deployment for the first time, you must point your Anchor.toml file to the network you've deployed to and run

anchor migrateThis will call the initialize method to create the token vault. No specific calling key is needed - it can be called by anyone, and is a once only operation for PDA vault creation. Subsequent runs will fail.

Any problems in this process can be triaged in the migrations/deploy.js file, which is what anchor migrate executes.

The mint authority of the xSTEP token must be set to the PDA vault address ANYxxG365hutGYaTdtUQG8u2hC4dFX9mFHKuzy9ABQJi

For single token staking, how do we calculate the APR in % that the users would receive?

This has to be calculated using historical deposit data, through whatever means you are making deposits. I would like to enhance this contract to use farm type distribution-over-time logic, but we kept this simple for now.

what's the purpose of the emit_price handler?

A client can use a simulate call in anchor to get back the token ratio. Just another way of doing things - it's similar to a solidity view.

Also, be sure to check out and maybe use instead the generic branch. It handles the xToken mint creation and ownership for you using a PDA. We used what's in the master branch because we wanted to use a specific mint that we generated as the xToken.